Five forces analysis

This is a way of analysing the attractiveness of an industry

This is a method of evaluating an industry's attractiveness. Profit margins are often quite high in some areas, such as medicines, while they are continuously lower in others, such as retailing. The five forces analysis reveals why this is the case – and what a company can do to improve the profitability of its industry.

When to use it

● To determine an existing industry's average profitability level.

● To identify ways for your company to become more profitable.

Origins

In the mid-1970s, Michael Porter was a junior faculty member at Harvard Business School, with a background in microeconomic theories of 'industry organization.' That corpus of knowledge was mostly concerned with ways to prevent businesses from gaining excessive profits (for example, by preventing them from getting monopoly power). Porter realized he could recast those principles as a way of understanding why some businesses were continuously lucrative in the first place. He published several academic studies that demonstrated how industrial organization and strategic thinking could coexist. In 1979, he published a classic essay in the Harvard Business Review called "How Competitive Forces Shape Strategy," which popularized his views. Competitive Strategy, his work on the same subject, was published the following year.

The five forces model was the first systematic framework for analyzing a company's immediate industry. Most managers had previously utilized a 'SWOT' analysis (strengths, weaknesses, opportunities, and threats), which is a valuable but unstructured approach of outlining challenges that a company faces.

What it is

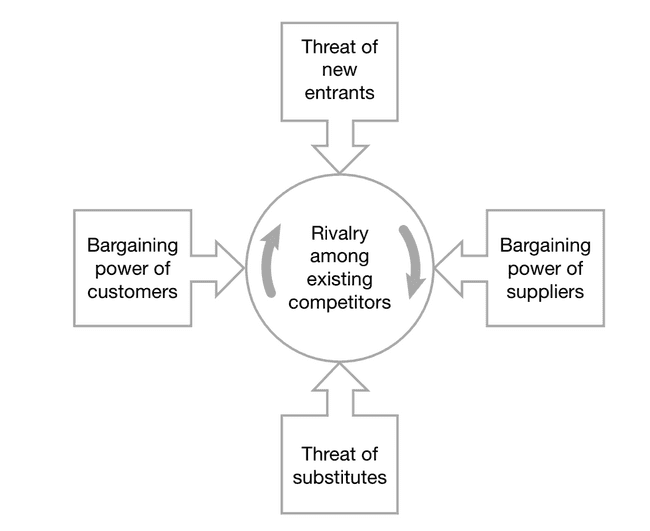

The five forces analysis is a framework for analyzing the level of rivalry within and surrounding an industry, as well as the industry's overall 'attractiveness' to competing enterprises. In contrast to the macro-environment (such as geopolitical developments), which often affects a sector indirectly or more slowly, these factors collectively make up the micro-environment of forces close to the enterprise. The following are the five forces:

● Threat of new entrants: Profitable markets attract new entrants, lowering profitability. Firms may not always be able to enter profitable markets, for a variety of reasons, including financial or technological obstacles, as well as governmental requirements. As a result, thinking about the barriers to entry in an industry that make it difficult for new competitors to enter is useful. Pharmaceuticals and semiconductors, for example, have extremely high entry barriers; retailing and food items, on the other hand, have comparatively low hurdles to entry.

● Threat of substitute products or services: The presence of products outside the immediate market that serve similar demands makes it easier for clients to migrate to alternatives, limiting market profitability. Bottled water, for example, might be used as a substitute for Coke, whereas Pepsi is a competitor's product. The more popular bottled water becomes, the more difficult it becomes for Coke and Pepsi to generate money.

● Customers' (buyers') bargaining power: The price customers pay for a product is heavily influenced by the strength of their negotiating position. For example, if Wal-Mart or Tesco decide to sell your new line of spaghetti sauces in their stores, you must accept whatever price they offer (as long as you aren't losing money on the deal). There are numerous potential sources of customer bargaining power, such as their size, importance, and ease of switching between suppliers.

● Supplier bargaining power: This is the inverse of the previous force. Some suppliers provide components or services that are so vital to you that they can charge exorbitant prices. If you want to make biscuits and there is only one person selling flour, you have no choice but to buy it from them. Intel is well-known for its bargaining power in the PC/laptop industry; by convincing customers that its microprocessor ('Intel Inside') was the best on the market, Intel significantly increased its bargaining power with Dell, Lenovo, and HP.

● Competitive rivalry intensity: This refers to how industry competitors interact with one another. Of fact, most businesses assume they face 'strong' competition, but the truth is that competitive rivalry differs substantially by industry. The 'big four' accountancy companies and many retail banks, for example, compete in a gentlemanly manner, focusing on brand and service while eschewing price rivalry. The airline sector, on the other hand, is noted for its low prices and flashy characters who make personal assaults on one another.

These forces, when combined, provide a comprehensive picture of an industry's attractiveness, as assessed by the average degree of profitability of its enterprises.

How to use it

The five forces framework can be applied in two ways: first, to describe the current state of your industry, and second, to generate suggestions for improving your company's competitive position.

It's good as a descriptive tool to go over each of the forces one by one and analyze how powerful they are in your current circumstance. Competitive Strategy, by Michael Porter, is a full checklist of factors to consider when conducting this analysis. This can be summarized by using a single '+' sign for a force that is somewhat in your favor, and a single '–' sign for a force that is severely against you. This analysis should assist you in determining why your industry is desirable or unattractive. It also identifies which forces pose the most threat. In the pharmaceutical business in Europe, for example, one would certainly conclude that buyer bargaining power, particularly that of governments, is the greatest single threat.

The second aspect of employing the five forces is to utilize the analysis to come up with methods to improve your competitive position - so you can 'push back' against the most powerful forces at work. In pharmaceuticals, for example, if government buyers have a lot of bargaining power, one way to counter is to increase your own bargaining power – either by developing a really exciting drug that consumers demand, or by becoming bigger and more powerful yourself (see, for example, Pfizer's attempt to buy AstraZeneca in 2014).

Top practical tip

Second, it makes sense to concentrate your efforts on the one or two (out of five) forces that are most important to your future profitability. Your analysis can lead you to believe that the largest concerns are customer bargaining power and internal competitive rivalry. Following that, your strategy conversations should be focused on those themes.

Top pitfall

The third problem is wrongly identifying the industry's boundaries. Which competitors are your direct competitors should be carefully considered. For example, focusing on a certain country is common. If you work in banking, the relevant industry may be "retail banking in France" or "commercial banking in Canada", rather than simply "banking".

Notion Templates

Get this high quality templates to help you with implemenation!

Further reading

Porter, M.E. (1979) ‘How competitive forces shape strategy’, Harvard Business Review, March–April: 21–38.

Porter, M.E. (1980) Competitive Strategy. New York: Free Press.