Customer lifetime value

One useful way of thinking about your customers is as an investment

Consider your customers as an investment: you invest in them early on to attract their business and establish loyalty, and you recoup that investment over time with a steady stream of sales. A quantitative technique for modeling this concept is customer lifetime value. It has a big impact on how you allocate resources at different stages of the client relationship.

When to use it

● To evaluate your customers' potential future value. br>

● To determine how much to invest in client loyalty programs and CRM systems.

● If you are losing customers, you must make changes.

Origins

In the late 1980s, the concept of customer lifetime value was developed by merging insights into the determinants of customer loyalty with financial net present value estimates. It was first explored in Shaw and Stone's book Database Marketing (1988). The notion was subsequently further refined in a number of academic articles as well as by consultancies like Edge Consulting and BrandScience.

What it is

Customer lifetime value has a technical definition, and there is a formula for determining it. It can also be utilized in a more qualitative way to reveal how companies allocate their marketing budgets.

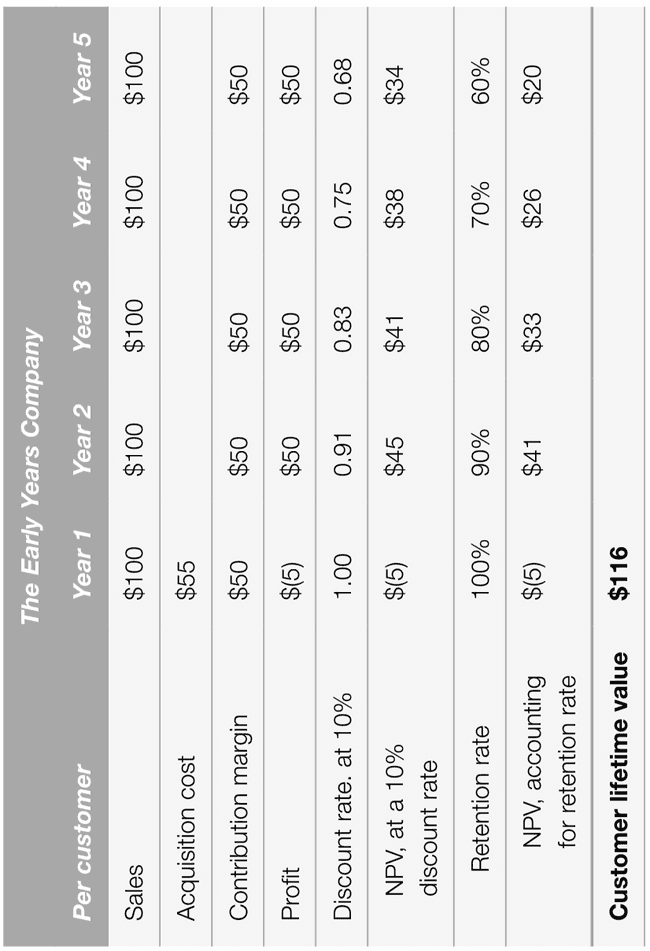

Customer lifetime value (CLV) is the net present value of future earnings to be earned from a particular number of newly acquired or existing customers over a given period of years, taking the technical definition first. It is possible to generate a particular estimate for CLV, as shown below, which is highly valuable when considering things like building a loyalty program or investing in a customer relationship management database.

CLV is an essential idea in general because it encourages businesses to focus on the long-term health of their customer relationships rather than quarterly revenues. For example, it is usually more cost-effective to keep an existing customer than to acquire a new one. Many businesses have acted on this knowledge by investing in loyalty programs and providing discounts to their existing consumers.

How to use it

CLV is determined by establishing assumptions about a customer's predicted retention and spending rate, as well as a few other easily determinable variables. Consider the following illustration.

We calculate the CLV of an average customer by tracking her childcare product purchases over a 5-year period, after which we assume her child has outgrown the life stage for which the products are appropriate. She spends $100 every year on goods that are highly profitable, giving the company a $50 contribution margin. After variable expenses like cost of goods sold and advertising are removed, the contribution margin is what's left. Given a $55 acquisition cost for this customer, we can see that the corporation loses money in the first year, but gains $50 in incremental contribution margin for the next four years.

To arrive at CLV, we calculate the net present value, or NPV, of each year's profit or loss using a 10% discount rate. We then anticipate a retention rate for each year, considering the possibility that she will transfer to another brand or cease buying the products. As a result, she has a 60% chance of continuing to buy the products in the fifth year. The average customer's CLV is calculated by adding the NPV figures after accounting for the retention rate.

Different client segments can be included in this initial computation. For instance, you might divide your audience into three segments based on age or spending patterns, and then alter the figures in the table to match your expectations for how much they spend, how loyal they are, and so on. You may add another layer of analysis by looking into whether there are any marketing programs that could be implemented to improve the annual retention rate.

CLVs will vary by client category, and doing an analysis will reveal high-value and low-value customers. You can then opt to adapt your marketing efforts based on the results of this investigation. Creating plans to keep a small group of high-value clients, for example, may be the best use of limited cash.

Top practical tip

After that, you can utilize the process to make some decisions about marketing spending. Is it reasonable to invest millions of dollars in a customer loyalty card, for example? What effect do you think this will have on retention and spending rates? This research will reveal that the benefits of some suggested investments outweigh their costs.

Top pitfalls

Further reading

Berger, P.D. and Nasr, N.I. (1998) ‘Customer lifetime value: Marketing models and applications’, Journal of Interactive Marketing, 12(1): 17–30.

Shaw, R. and Stone, M. (1988) Database Marketing. Hoboken, NJ: John Wiley & Sons.

Venkatesan, R. and Kumar, V. (2004) ‘A customer lifetime value framework for customer selection and resource allocation strategy’, Journal of Marketing, 68(4): 106–125.