The BCG growthshare matrix

The BCG ‘growth-share matrix’ is a simple model to help with priorities

Most businesses have multiple lines of operations. It might be difficult to figure out how multi-business organizations fit together and where future investment priorities should be. A simple model to aid in this study is the BCG's 'growth-share matrix.'

When to use it

● To describe the various business lines within a multi-enterprise organization.

● To assist you in determining which businesses to invest in and which to sell.

Origins

Firms in the United States and Europe had risen considerably in size during the postwar period. Conglomerate companies like ITT, GE, and Hanson had begun to develop; they typically featured a huge number of unrelated businesses that were all managed using financial metrics from the center.

The Boston Consulting Group created the BCG growth-share matrix in response to this diversification trend. It provided a straightforward way to map all of a company's many businesses onto a 22 matrix, as well as some simple recommendations for how corporate headquarters should handle each of those firms. It became quite popular among huge corporations because it assisted them in learning about a wide range of enterprises.

The BCG matrix's simplicity was also one of its drawbacks, and several variations were proposed throughout time, including by the consulting firm McKinsey and General Electric (GE). Versions of this matrix were utilized throughout the 1970s and 1980s, but when people realized there were few synergies possible among unrelated industries, the trend in the 1990s was toward considerably less diversification. As a manner of focusing, large companies were split up, sometimes by private-equity driven 'corporate raiders,' and sometimes by their own leaders. The BCG matrix went out of favor over time, although it is still utilized today — albeit in a more casual manner.

What it is

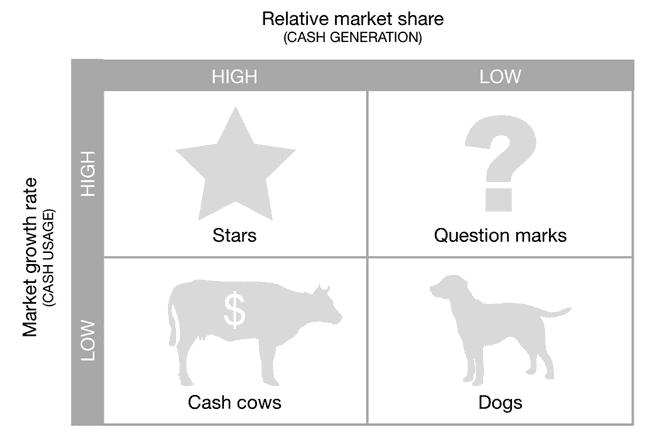

There are two dimensions to the BCG matrix. The vertical axis represents'market growth,' which is a measurement of how quickly a certain market is expanding. For example, the milk market may increase at 1% per year, but the smartphone industry may develop at 10% per year. The horizontal axis represents'relative market share,' or market share relative to the market leader, and it reveals how powerful your company is in that market. For instance, you could have a 20% share of the slow-growing milk industry and a 4% share of the fast-growing smartphone market.

The size of the circle used to plot each business line on the matrix is often indicative of the quantity of sales generated by that business (in top-line revenues). The matrix's quadrants are then given names:

● High growth/high share: These are the'star' businesses in your portfolio that are the most appealing.

● High growth/low share: These businesses are referred to as 'question mark' businesses since they have a modest market share but are in rapidly rising areas. They are thought to have potential.

● Low growth/high share: These are your 'cash cow' businesses, which are highly profitable but operate in mature areas with low growth. They frequently generate strong, positive cash flows.

● Low growth/low market share: These are known as 'dog' businesses and are the weakest in your portfolio. They must be quickly turned around or exited.

The horizontal 'share' dimension is a proxy for the overall strength of your firm in terms of its core capabilities, while the vertical 'growth' dimension is a proxy for the overall attractiveness of the market in which you compete.

How to use it

You receive an instant 'image' of your corporate portfolio by placing all of your firms into a single matrix. Because several conglomerate firms in the 1960s and 1970s, when the BCG matrix was popular, had 50 or more independent lines of business, this was a useful element of the matrix.

The matrix also gives you some important information about how well your businesses are doing and what you should do next. Cash cow businesses have positive cash flows because they are in mature and gradually declining markets. Question mark enterprises, on the other hand, operate in uncertain growth markets and demand capital. As a result of this study, one reasonable conclusion is to withdraw money out of the cash cow firms and put it into the question mark enterprises. These people gain in popularity, their market share increases, and they become celebrities. As those stars fade, they become cash cows, and their surplus funds are utilized to fund the next generation of question mark companies. As previously stated, dog enterprises are often closed as soon as possible, while they can occasionally be quickly turned around to become question marks or cash cows.

While this rationale makes sense, it effectively limits the role of corporate headquarters. When you think about it, the purpose of 'capital markets' in developed countries like the United Kingdom and the United States is to provide firms with capital to invest. If you believe a company is in a good market, you will likely invest more money in it; if you believe it is in a bad market, you may sell your shares. As a result, it makes little sense for corporate headquarters to limit themselves to the job of moving money between businesses; capital markets are often more efficient in this regard.

In other words, the BCG matrix's biggest flaw is that it undervalues the potentially critical role that corporate headquarters might play in generating value across the portfolio. Diversified enterprises now have a far better awareness of how they contribute and destroy value, such as by sharing technologies and customer relationships across businesses and moving knowledge between lines of business. The BCG matrix entirely ignores opportunities for synergy of this nature.

Top practical tip

Remember that the market-growth and market-share dimensions are proxies for the market's underlying attractiveness and the business's underlying strength. Other methods of assessing these measurements are frequently beneficial. Instead of believing that growth is the most important component, you might do a detailed 'five forces study' of a market to better grasp its total appeal.

You should also consider how to define market share carefully. Is BMW, for example, a very small part of the overall vehicle market (less than 1%)? Or does it have a significant market share (> 10%) in the premium sedan segment? The status of the firm changes considerably depending on how the market's limits are defined. It's crucial to consider what the analysis informs you and how much the outcome is influenced by the exact numbers you used as inputs.

Top pitfall

The most obvious strategy to mitigate this risk is to create a case for reinvesting in the company. Even if the company is mature, it may still be able to regenerate and grow with the correct amount of funding. Hopefully, the corporate leaders at headquarters are well-informed enough to recognize this opportunity.

Further reading

Campbell, A., Goold, M., Alexander, M. and Whitehead, J. (2014) Strategy for the Corporate Level: Where to invest, what to cut back and how to grow organizations with multiple divisions. San Francisco, CA: Jossey-Bass.

Kiechel, W. (2010) Lords of Strategy: The secret intellectual history of the new corporate world. Boston, MA: Harvard Business School Press.